Mortgage rates are changing daily at the moment, so it is difficult to publish any with any certainty of accuracy. We have however provided useful information about the current mortgage market, how to search for today’s rates and factors to consider for your mortgage.

This article does not constitute advice. Professional advice should be taken prior to acting on any part of it. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.

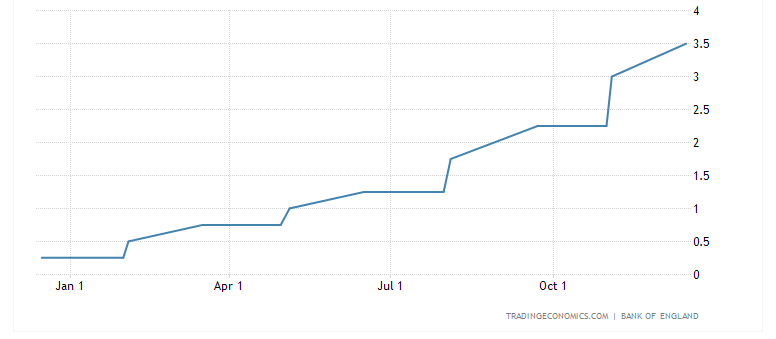

Current Base Rate of Interest: 3.5%

This chart shows the increase in the base rate of interest in 2022.

Finding a mortgage for doctors and dentists

The best way to maximise your mortgage position is to regularly keep track of mortgage rates.

Our Mortgage Finder allows you to search for mortgages that are actually available today. Once you have done some initial research, please contact us to discuss how we can help you.

Take action in 2023

There is never a better time to take action with your mortgage. Even if that action is simply finding out your options.

- Use our Mortgage Finder to research your options. Our online tool gives you access to the latest rates from thousands of lenders. Use the filters to refine your search.

- A Mortgage Review, by a professional independent mortgage advisor, will outline the most suitable overall deal for you in these unusual circumstances. Call us today to discuss your options.

- Stay connected with us via our blog, social media and email newsletters for the latest rates and news on the rapidly-changing mortgage market.

- Use our Mortgage Affordability Calculator to calculate how much mortgage you could afford to repay each month.

As independent brokers, we have access to all mortgage products from all lenders. Our experience in the dental and medical sectors too, means we have built relationships with specialist lenders over the 30 years we have been in business, enabling us to provide a bespoke and personalised service to you.

Mortgages for doctors and dentists

Whether you are looking to remortgage and save money on your current monthly mortgage payment, invest in a buy-to-let property or require finance for your first home, Dental & Medical Financial Services have access to the lowest rates on the market.

As independent mortgage brokers, we can help you decide which mortgage is most suitable for your situation.

It is also important to carefully consider the term of your mortgage to take into account your retirement plans too.

We will help you choose from:

- A wide range of fixed rate mortgages

- Tracker mortgages

- Offset mortgages, which may suit you if you have savings

- Low deposit options for junior doctors and newly qualified dentists buying their first home

- Buy-to-let mortgages

7 things to consider when looking for a mortgage

- Low rates are important and tend to be what most homeowners base their decisions on.

- As well as finding low rates though, it is vital to find mortgage deals that offer low fees, so that the overall cost of your mortgage is as low as possible.

- Find a lender that has reasonable early repayment fees, so if life takes a different turn you will not be left footing a hefty bill.

- If you are remortgaging, check any early repayment charges on your existing deal too. Sometimes it can benefit you financially to pay these fees to be able to switch to a better rate.

- How is your credit score? This could have an impact on the amount you can borrow and the rate.

- Working with an independent mortgage broker means you have access to all products available on the market.

- Working with specialist mortgage brokers to the dental and medical sector, means we have built relationships with specialist lenders that understand the income of doctors and dentists.